January 27, 2023

Bitcoin and the Five C's: Capital

Before a lender extends financing to a prospective borrower, it is reasonable for the lender to adequately assess the overall risks associated with lending to this borrower.

As explored in Part 2 of this blog series, a borrower’s FICO score and credit history is one major factor along with the borrower’s capacity, or ability to repay based on existing liabilities as discussed here in Part 3. The biggest limitation of these first two C’s is that a borrower’s past repayment history and their current income, do not necessarily predict future outcomes.

For example, a borrower’s W2 may show $100,000 income, for the previous year, but that doesn't guarantee the borrower will still be employed for any length of time. Also, while credit reports offer insight into a borrower’s reported obligations, there are other types of liabilities that are not reported to the credit bureaus and therefore not able to be counted in a borrower’s DTI.

The methodology begins to shift slightly with the third "C": Capital.

Evaluating Borrower Capital

Rather than metrics which establish a borrower’s historical habits and likelihood of ongoing economic stability, Capital examines the current assets held by the borrower. By requiring a loan applicant to provide proof of their cash on hand, retirement funds and other assets, the lender is provided some comfort that the new debt obligation could still be serviced, even if the Capacity of a borrower is diminished.

Overall, Capital refers to the financial resources that a borrower has available to invest in their project or business. In addition to cash on hand, lenders also consider a borrower’s overall net worth which is calculated by subtracting a borrower’s total liabilities from their total assets including the value of cash, real estate and investments. A healthy net worth is generally considered to be a positive indicator of financial stability and ability to repay a loan.

Lenders requiring a potential borrower to prove they have assets on hand in order to ensure they are well capitalized before extending a loan to them, may seem a bit counterintuitive. One might wonder “why does someone who is ‘well capitalized’ even need a loan to begin with?” - that is an excellent question! In our hyper-financialized and outrageously inflated world, the ratio between wages and cost of living makes it unrealistic to pay cash for large expenses.

As a result, borrowing money for just about anything has become commonplace. Tragically, that 20% down payment on a home in 2023, likely could have paid for the entire home in 1975 despite taking the same amount of time to accumulate. But even having the 20% in your bank account may not be enough to satisfy the due diligence requirements when a lender is assessing a borrower’s Capital.

Verification of Assets

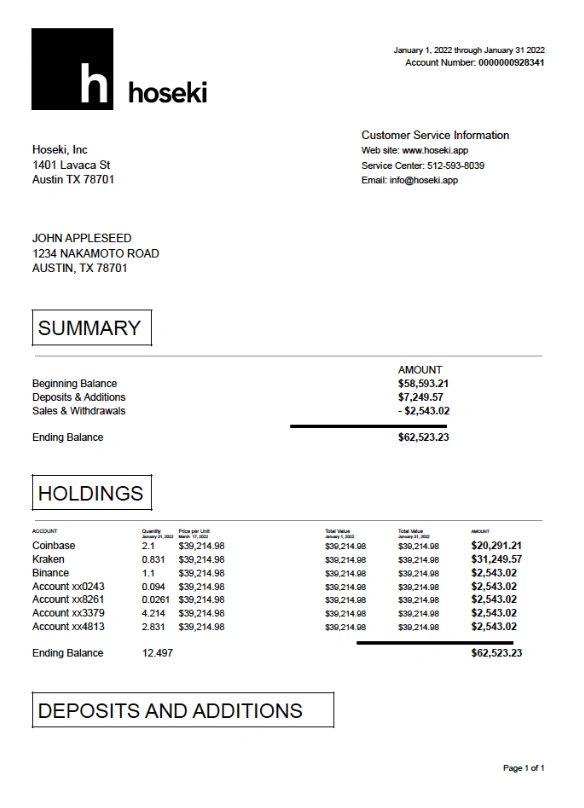

John wants to buy a home for $500,000. The mortgage he is applying for at Acme Bank requires a borrower to make a 20% down payment ($100,000) towards the purchase of the home. Furthermore, Acme will need to verify that the funds for the down payment is coming from John and that those funds in fact belong to him without encumbrance.

In other words, it would be unacceptable for John to borrow $100,000 from Sally and utilize those funds for the down payment. Such a scenario would represent layered risk because funding the mortgage would mean John now has two loans to repay: one to Sally and one to Acme.

To establish true ownership of the funds and satisfy Acme’s requirement, John is required to produce a bank statement which reflects a balance of at least $100,000. Not only that, the bank statement cannot show any recent “large deposits” that are out of the ordinary (i.e. non-paycheck) as that could be an indicator of a Sally type loan situation. If a lender sees a large deposit on a borrower provided bank statement in the prior 60 days, they will require a paper-trail to document where those funds came from.

This period is sometimes referred to as “seasoning”. The only acceptable source is funds to use in this transaction are funds that are derived from the borrower’s other assets such as transfers from John’s other accounts or liquidation of a 401k. Any funds that originate from external sources cannot be counted towards the borrower’s verified assets, and they cannot be used for the transaction unless they are seasoned for 60 days and no longer appear as large deposits.

Bitcoin as Capital

Consider the implications of the above scenario if the source of John’s down payment was in his Bitcoin holdings. Traditional mortgage lenders do not consider Bitcoin to be an asset; they simply do not recognize it. Unfortunately for John, this means he would not only have to sell his bitcoin and transfer the cash proceeds to his bank account, he would ALSO need to wait 60+ days so that the deposit is no longer visible on the bank statements that Acme will require.

This specific issue is more common than you might imagine, mostly due to a lack of general education when it comes to the nuances of lending. At Hoseki, we have created a product that helps mitigate these situations and would empower John to move forward with the loan application without requiring him to sell his bitcoin assets.

John would simply verify his bitcoin holdings on the Hoseki platform and generate a PDF asset statement which contains all of the elements a lender requires to satisfy a Verification of Assets condition. Note that while this statement may satisfy Acme’s requirement, Bob would still need to find a way to bring $100,000 to the closing table for the down payment one way or another. This means that while he may not have to wait 60 days if the lender accepts this statement, he would still need to sell the bitcoin if he has no other assets.

This scenario is just scratching the surface and is a response to the current requirements of legacy lending institutions. However, it’s not difficult to imagine what the future of Capital within a bitcoin standard could look like and how a lender’s ability to properly evaluate risk are enhanced.

In a bitcoin standard, lenders could conceivably look at a borrower’s bitcoin holdings and measure factors such as the growth of their savings over time, the duration that sats are held without moving and the quality of a borrower’s custody model as determinate factors for evaluating their creditworthiness.

A borrower’s ability to demonstrate the strength of their “Capital” is significantly enhanced with Bitcoin in ways we are just beginning to understand. No more waiting for 30 day bank statement cycles, no more questioning if a borrower’s assets are unencumbered or truly belong to them. Bitcoin is simply the most auditable financial network and holding bitcoin is slowly becoming a strong indicator of creditworthiness.